Real Estate Acquisitions Firm

Our company is dedicated to:

Deliver quality and authentic real estate education

Provide investors with investment vehicles in the real estate industry

Provide management and strategies to increase cash flow of our real estate properties

Increase investors’ ROI (return on investment) over time

Provide and execute at the right time best exit strategies to investors to maximize ROI; strategies such as refinancing or disposing the property

Distribute 80% of Cash Flow to the investors and 20% of Cash Flow to US GROUP HOLDINGS (the “Manager”) per Operating Agreement

Team:

Jonathan Carrera, Managing Member of US GROUP HOLDINGS

Jonathan Carrera is 34 years old and a structural engineer. He was born in Ecuador and moved to the United States when he was a teenager. He obtained a Bachelor of Science in Civil Engineering from Syracuse University and a Master of Science in Civil/Structural Engineering from Purdue University. Currently, he works part-time at Parsons Corporation as a bridge/structural engineer. Jonathan has 8+ years of experience designing and analyzing complex bridges. He is part of a team of 15+ bridge engineers where they all work collaboratively on large scale complex bridges. Jonathan has been involved in the design and analysis of many different types of bridge projects such as: steel & concrete simple and multiple spans, post-tensioned concrete box girder, steel composite tub-girder, steel & concrete tied-arch, and steel truss bridge structures.

As a bridge engineer, Jonathan has acquired the following skills: engineering design, computer-aided structural analysis, structural drawings production for construction, knowledge of bridge & building engineering design codes and requirements, review of engineering project reports (reports such as hydraulics, seismic, environmental, structural, geotechnical, soils, etc), structural inspection reports, self-management, planning and organization. Although multi-family real investing is a different field from engineering, Jonathan has acquired the necessary technical and management skills as an engineer needed to inspect, acquire and manage real estate properties. As an engineer, part of his job is to plan for unforeseen circumstances that can affect the economics, safety, and other aspects of a bridge project. Therefore, you can rest assured that your investment will be in great hands to anticipate and solve problems during the acquisition, inspection, and management of a real estate property, and at the same time add value to the real estate projects to increase ROI. With Jonathan’s experience as a bridge engineer and involvement in large scale complex bridge projects; investors can trust that their investments will be used responsibly by the managing members of US GROUP HOLDINGS and third-party property management companies. You can learn more about Jonathan Carrera at his LinkedIn: Jonathan Carrera, P.E. | LinkedIn

Robert Taylor Jr, Managing Member of US GROUP HOLDINGS

Robert Taylor Jr is currently 31 years old and has a strong experience in facilities management. Robert was born in Accra, Ghana and spent a portion of his childhood growing up there. He moved to the United States at the age of 10 to pursue higher education. After elementary school and high school in Chicago, he obtained a Bachelor of Business Administration (B.B.A) with emphasis in Finance and a Master degree with emphasis in Communication from Western Illinois University in Macomb, IL. Robert began his career in facilities management at WPD Management which is a property management company. Robert has 5+ years of experience managing maintenance engineers with various skill sets such as general repairs, plumbing, HVAC and electrical work. He has managed a team of 20+ maintenance engineers in developing effective strategies to save maintenance costs for third party clients, fulfilling residents’ needs in their household and servicing the maintenance needs consisting of approximately 5,000 units. Robert has been involved in the management of large real estate properties such as high-rise buildings consisting of 180 to 220 units located in Chicago. He also has contributed to the growth and success of other client portfolios by restructuring and improving their preventative maintenance procedures.

During his tenure in facilities management, not only has Robert enhanced his skillsets related facilities management but has only learned various strategies in order to save cost for owners such as executing proper eviction protocols, cost saving negotiations for lease renewal, rent collections, unit turn budgeting and many other strategies which can increase investors ROI. Robert’s initiative in property management has been to develop strategies that can save maintenance cost such as minimizing drive time for WPD’s maintenance engineers traveling to various sites and hardware stores, discussing the best cost-effective strategies to solve maintenance issues for the long term and push back on certain maintenance requests that we feel could be performed by the resident. With Robert’s experience in facilities management and his time spent working in property management, investors can rest assured that their investments will be handled very well by the managing members of US GROUP HOLDINGS and third-party property management companies. You can learn more about Robert Taylor Jr at his LinkedIn: Robert Taylor | LinkedIn

Giovanny Begein, Managing Member of US GROUP HOLDINGS

Giovanny Begein is 32 years old and has a strong experience in the banking industry. He was born in Haiti and moved to the United States when he was a teenager. Currently, he works at BMO Harris Bank as a relationship banker. Giovanny has 6+ years of experience as a banker working at BMO Harris Bank and Fifth Third Bank. As a banker, he has been involved in issuing million dollars in loans & mortgages as well as bringing other types of investments for the bank. As a banker, Giovanny has acquired the following skills: Risk analysis and planning, business strategist and development, business networking and creating expansion structure, sales, credit analyst. Additionally, he spends his time managing multifamily real estate properties that he owns. Giovanny has acquired business management skills needed to successfully manage and optimize real estate properties and execute US GROUP HOLDINGS’ business plans. With Giovanny’s skills set and his time spent as a banker and managing his real estate properties, investors can be confident that their investments will be handled responsibly. You can learn more about Giovanny Begein at his LinkedIn: GIOVANNY BEGEIN | LinkedIn

Note: US GROUP HOLDINGS along with third-party property management companies will manage the real estate property after acquisition

The Process of Investing with US GROUP HOLDINGS:

1. Becoming an Investor: We will schedule a call with you to understand your goals and objectives. This will allow us to get know to each other and understand if the Company’s goals align with yours.

2. Analyzing the Deal: You will get access to the details of the multi-family deal for your assessment. You will gain access to details such as: photos, financial projections, building plans, reports and any other relevant information.

3. Funding & Investment: After you have made the decision to invest with us; US GROUP HOLDINGS will provide you with legal documents required per SEC (Securities Exchange Commission) / securities law. At this point, you will wire/send funds directly to US GROUP HOLDINGS and at the same sign the legal documents. Your investment is locked and will remain within the multi-family deal until the property is sold at a later time

4. Cash Distributions: Throughout the course of the investment (7 – 10 years holding period), you will receive monthly or quarterly cash distributions depending on your investment amount. These cash distributions come from the property’s monthly cash flow after all monthly expenses are paid. Your cash distribution amount is based on your ownership percentage in the property. At the end of each fiscal year, you will receive an IRS Schedule K-1 Form to file your income tax return. You will retain an ownership percentage in the property throughout the holding period regardless of your cash distribution amount.

Current Real Estate Property Deal Offering:

Information of the multi-family property deal and SEC approved regulation A or D offering coming soon on this section

Real Estate Education:

Click on this “Education” button to learn more about real state investing. You will learn about different topics such as: Cap Rate, Limited Liability Company, Net Operating Income, Regulation A Offering, Offering Circular Document, Real Estate Property Classes (Class A, B, C, D), Debt Service, Cash Flow, Depreciation Deduction, IRS Form 1065 & 8825 & Schedule K-1, Types of Income, Fractional Reserve Banking, Assets vs Liabilities

Description of Business:

Click on this “Description of Business” button to learn more about our business activities, objectives, goals and strategies

Due Diligence Checklist:

Click on this “Due Diligence Checklist” button to learn more about the items the Company will follow to assess the suitability of the property. Items such as: Proof of Income and Expenses, Property Insurance, Existing and New Debts, Title Review, Survey, Service and Maintenance Contracts and Other Agreements, Guaranties and Warranties, Taxes and Assessments, Property Management Agreement, Building and Zoning, Permits and Licenses, Environmental Report, Physical Inspection

FQAs:

Click on this “FAQs” button to learn more about Frequently Asked Questions

Why you should add real estate as an investment vehicle:

CASH FLOW: After all the expenses are paid, this income goes out to investors as monthly cash distributions

STABILITY: Multifamily is less volatile and continues to outperform traditional stock-based investments

TAX BENEFITS: Depreciation is a tax deduction (write-off) that enables you to keep more of your profits

LEVERAGE: You can leverage (use debt) real estate, this means you can buy a $10M property with only $2.0M down payment

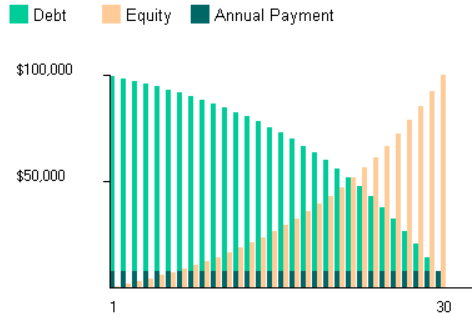

AMORTIZATION: Residents pay down your mortgage over time creating equity, this leads to long-term wealth

APPRECIATION: Forced appreciation through strategic management increases the overall value of the property

Add block patterns

Content on this space coming soon

Frame your images

Content on this space coming soon

Disclosure:

*As of January 1, 2022.

Investing involves risk, including loss of principal. Past performance does not guarantee or indicate future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. While the data we use from third parties is believed to be reliable, we cannot ensure the accuracy or completeness of data provided by investors or other third parties. Neither US GROUP HOLDINGS nor any of its affiliates provide tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Offers to sell, or solicitations of offers to buy, any security can only be made through official offering documents that contain important information about investment objectives, risks, fees and expenses. Prospective investors should consult with a tax or legal adviser before making any investment decision.

For our current Regulation A offering(s), no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth (excluding your primary residence, as described in Rule 501(a)(5)(i) of Regulation D). Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to Investor.gov

eCFR :: 17 CFR 230.251 — Scope of exemption.

eCFR :: 17 CFR 230.501 — Definitions and terms used in Regulation D.

For additional important risks, disclosures, and information, please visit: