We intend on engaging in the following activities:

i. The Company’s primary focus is to invest in multifamily and commercial properties that will appreciate over a seven (7) to ten (10) year holding period. The properties are selected based on criteria that includes a positive cash flow at purchase, good location and purchase price is less than replacement cost. The properties are then managed by a well-established third-party property management company during the holding period to maximize the appreciation for the investors

ii. In some circumstances, the Company may elect to purchase commercial properties that have potential to soon be or are cash flow positive, meaning properties that have a positive monthly income after all expenses (mortgages, operating expenses, taxes) and maintenance reserves are paid. These properties are also frequently referred to as “income-producing” properties. Nonetheless, the potential acquisition should have the likelihood to appreciate in value over the hold period. In order to determine if a property is “cash flow positive” our Manager will review the total gross rent, income, or receipts from the property and subtract any and all expenses including utilities, taxes, maintenance, and other reserve expenses. If this number is a positive number, the Company will deem the property “cash flow positive.” Depending on how positive the cash flow is will determine whether the management will purchase the property or not on behalf of the Company: there must be cash flow potential with which our Manager is comfortable.

iii. Invest in any opportunity our Manager sees fit within the confines of the market, marketplace and economy so long as those investments are real estate related and within the investment objectives of the Company. To this end, at some time in the future, the Company may also purchase additional properties or make other real estate investments that relate to varying property types including office, retail, and industrial properties. Such property types will likely be operating properties rather than properties under development. It is expected that the Company will only use the Class A Members and Class B Member (the “Members”) capital contributions net proceeds to purchase multi-family and commercial properties.

iv. In some circumstances, the Company may elect to enter into a joint venture agreement with another real estate developer or investor who may have certain resources or opportunities not otherwise available to the Company.

v. In all cases, the debt on any given property must be such that it fits with the Investment Policies of the Company. We intend on leveraging our properties with no more than 80% of their value.

Objectives:

The Company has definite objectives to fulfill its strategy. These include:

i. Penetrate the market of providing real estate opportunities for qualified individuals and/or business entities interested in achieving financial success by taking advantage of real estate investment opportunities in the Midwest (East North Central), South (East South Central) United States and nearby states; and potentially across the contiguous United States (however, the Company will not limit itself geographically); and

ii. Increasing profits as allowed by market conditions.

The Company will look to buy multifamily properties, in growth areas for the best possible price, thereby giving the Company an instant competitive advantage. A potential investor should note that the above criteria is subject to change according to market conditions.

Project investments may be individual or multiple properties and will generally consist of Class A, B, C assets with 25 to 100 units

Generally, the Company will seek opportunities which meet the following criteria:

| Type of Investment | Income |

| Acquisition Cap Rate | 4%+ |

| Pro-Forma Cap Rate | 5%+ |

| Cash on Cash at Purchase | 3% – 6% |

| Cash on Cash at Pro-Forma | 6%+ |

| Leverage | 70% – 80% |

| Existing Occupancy | 85%-95% |

| Capital Improvement | Minimal to $15,000/unit |

Investment Strategy:

The Company is seeking to invest in a diversified portfolio of income producing real estate assets and real estate related assets throughout the United States, specifically in the Midwest (East North Central), South (East South Central) United States and nearby states. Initially, the Company intends to target multifamily properties, but may acquire other property types that meet its investment objectives.

The Company may invest in income producing properties with positive cash flow, or in value-add properties that need some repositioning or capital investments and may not produce cash flow immediately. The Company may also invest in additional properties or make other real estate investments in other property types including office, retail and industrial properties.

We believe that there is an opportunity to create attractive total returns by employing a strategy of investing in a properties which are well-selected, well-managed and disposed of at an optimal time. Our principal targeted assets are investments in properties if compelling opportunities arise that present superior opportunities for above-market returns, that have quality construction and desirable locations which can attract quality tenants. These types of investments are, or relate to, properties generally located in central business districts or suburban markets of primary and secondary metropolitan cities, primarily located in Midwest (East North Central), South (East South Central) United States and nearby states

To this end, the Company’s overall strategy is to:

i. Identify Class A, B, C multi-family apartment communities in quality locations in the Company’s target markets, where the Company can add significant value through third-party hands-on management and/or appreciation potential;

ii. Buy in those communities at below-market prices, or at market prices where there is sufficient upside potential to obtain above-market returns over the long term;

iii. Make physical alterations and other improvements to those communities, where the Company can achieve significant benefit with minimal capital outlay; and

iv. Through third-party management, increase the rents to increase the overall value of the property.

Due Diligence and Financing:

When the Company identifies a location or a potential property, it will secure the necessary financing, sign a contract and place an escrow deposit to be held with the designated escrow agent. The Company will take the time necessary to complete all its due diligence to the property including: site inspection, reviewing all leases, income and expenses, as well as securing a first mortgage on the property. After the due diligence process has been completed, the Company will determine whether the property is suitable or not. If property is not suitable, the Company will cancel the contract and look for the next opportunity. If the property is suitable, it will proceed to close, typically 45 to 60 days.

Refinancing:

During the initial 12-36 months of owning and managing the property, the Company will analyze the market conditions in the area where the project is located. Simultaneously, we will investigate current interest rates. The Company will then decide whether the property should be maintained, refinanced, restructured (i.e. condominium conversion), or sold (disposition). These statements open the possibility of refinance before the 5-year target and dispose the property before the 10-year target stated in other sections.

Real Estate Investment Cycle:

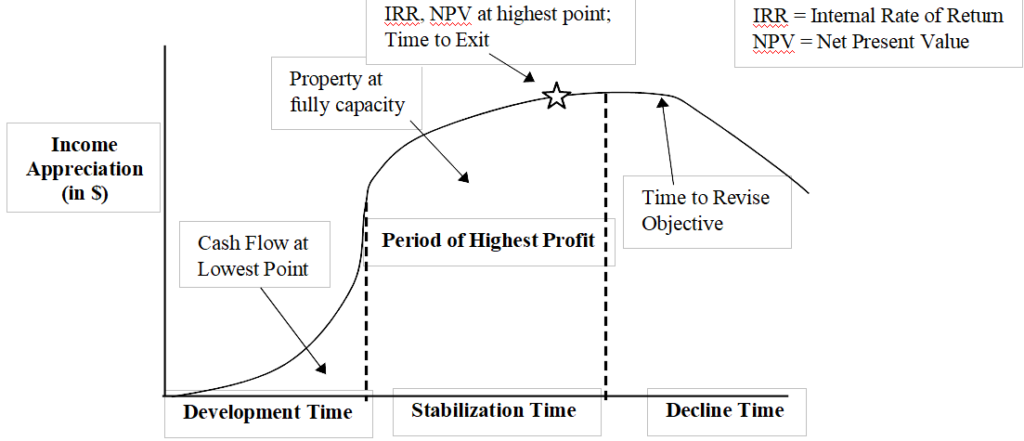

As shown below, the life cycle of a multifamily and commercial real estate property varies on an individual property basis, but generally all properties experience periods of development, stabilization, and decline. The art of real estate investment is determining at what cycle to invest and ultimately when to exit. A large part of being an effective real estate investor is knowing when to leave and not holding on to the property too long. It is the view of the Company that understanding and capitalizing on each period will maximize returns to investors.

The Company intends to purchase properties which the Manager believes will generate income from rents, as well as, growth from subsequent improved valuations. The Company will concentrate its investments on properties that:

i. Primarily, increase value of the property through increasing streams of income through third-party property management

The Company intends to concentrate its investments on real estate properties that:

ii. Tend to be at or below prevailing geographical market values; and

iii. Provide reasonably anticipated returns to investors

he Manager may elect to expand or contract the Company’s capitalization as needed to prudently meet the demands for the investment market and to further assure that the rates of return for investors are met or exceeded. The Manager believes to find conducive environments to purchasing a portfolio real estate properties with good market value, a strong potential of producing rent once stabilized or proven histories of producing income.

The Manager acknowledges that real estate market fundamentals constantly shift. The Company will remain cognizant of changes to the market and will adjust strategies as appropriate in order to best serve our investment partners as stewards of their capital and their trust. While the Manager anticipates achieving this investment objective in the time-frame referenced, it is possible that the time frame may be longer than anticipated and an Investor should be financially capable of having their money invested in the Company for an indefinite period of time.

Market Outlook:

The Manager believes that there is a market opportunity due to the following factors:

Shelter is a neccesity: People are always in need for a place to live and it is a necessity. People prioritize paying their rents as not doing so will trigger eviction leaving them without a shelter.

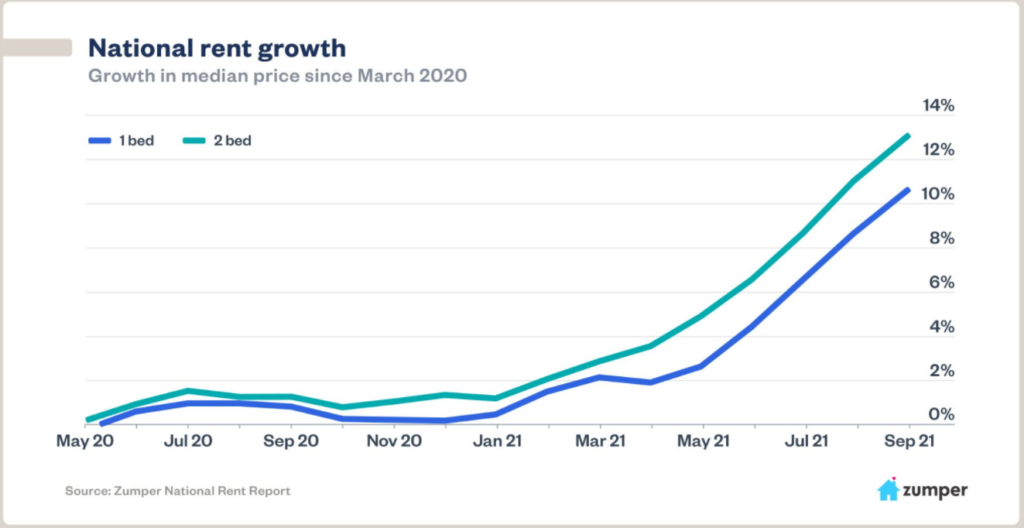

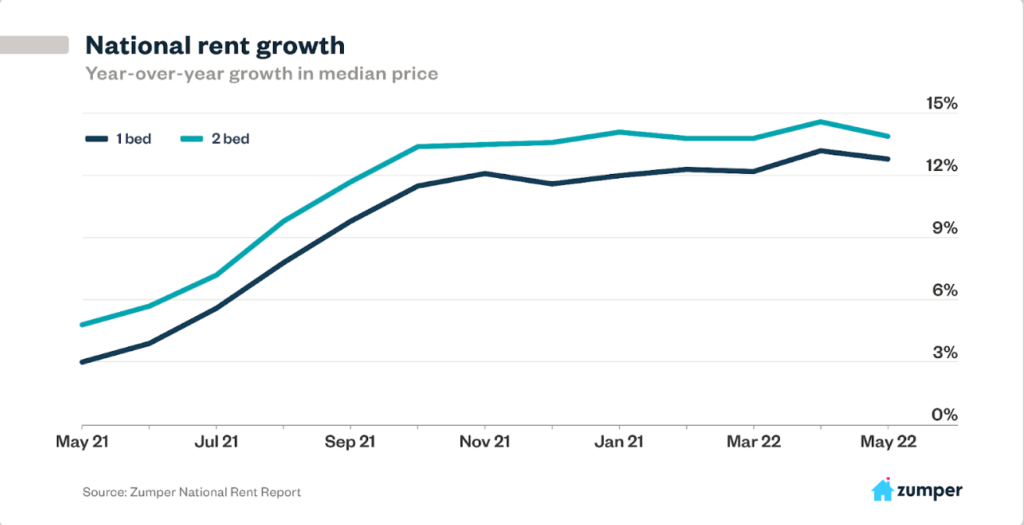

National Rent Growth: Per Zumper, the national rents continue to increase in the United States as shown in the graph below.

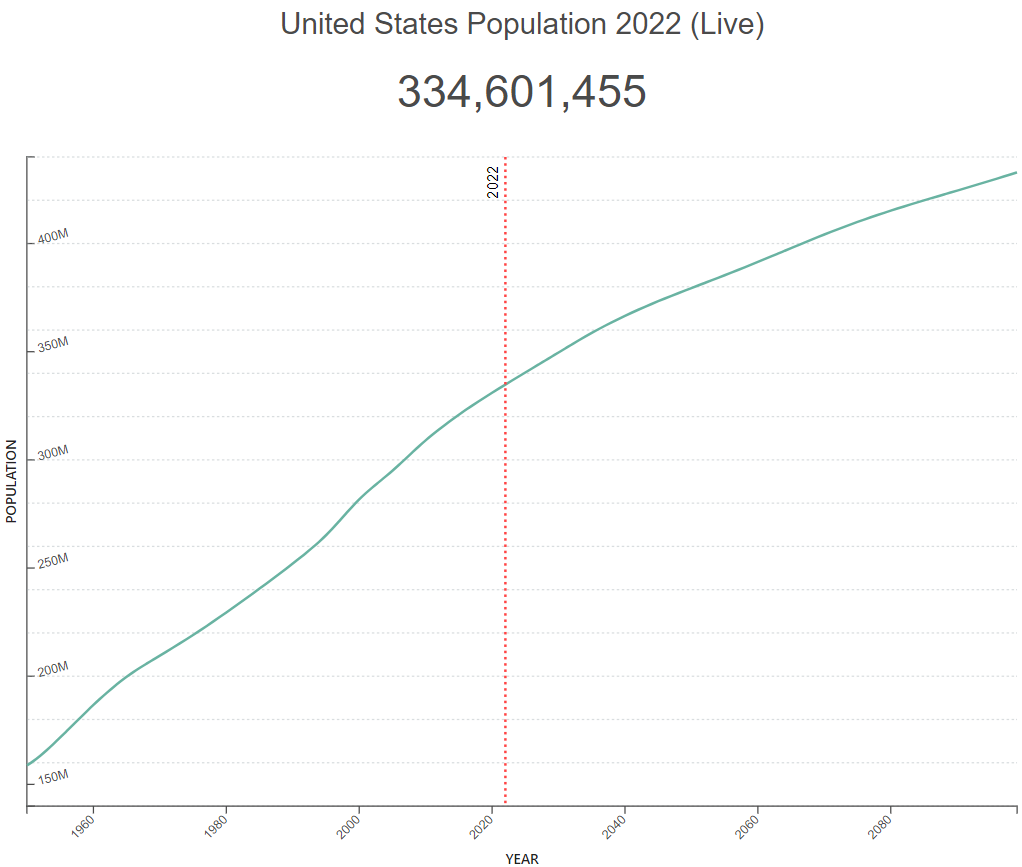

Population Growth: United States population is expected to continue to grow throughout the century with no foreseeable decline. By 2052, the U.S. population is expected to surpass 380 million people (See graph below). As U.S. population increases the demand for housing units will increase.

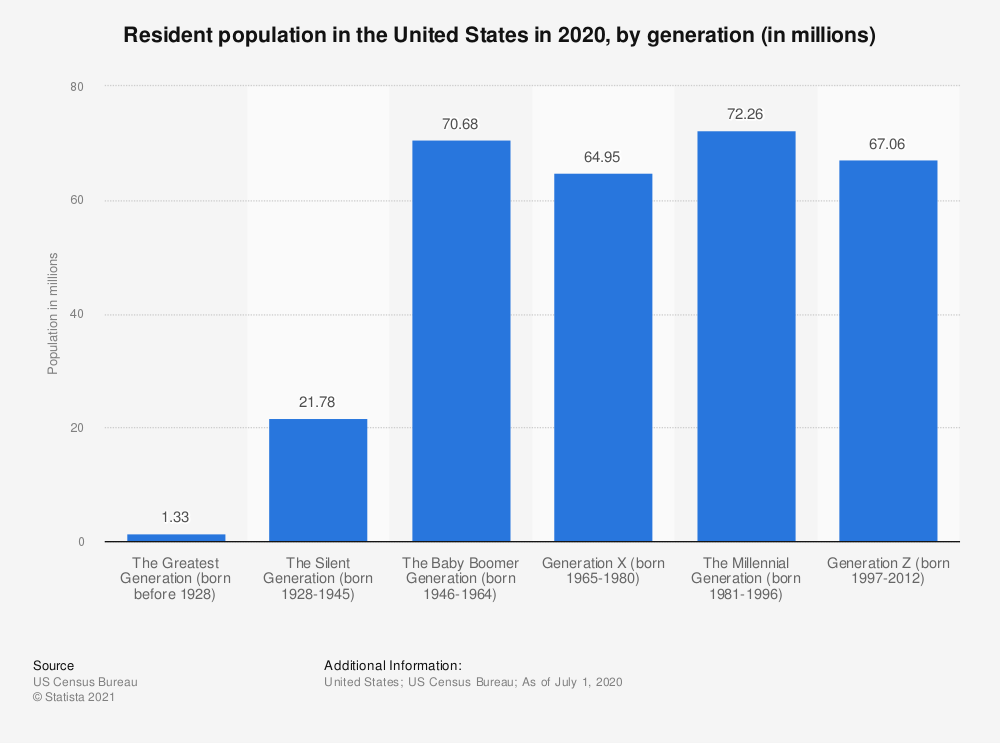

Previous Generations Entering Rental Market: Rental demand is expected to grow as previous generations enter prime renter age (20 – 34 years old).

Generation Y (Millennials): Born 1981 – 1996

Generation Z: Born 1997 – 2012

Generation Y (Millennials) (Echo Boomers) has a population size of 72.26 million as compared to the Baby Boomer Generation with 70.68 million. Rental demand is expected to grow through 2023 as Generation Y continue to enter prime renter age of 20 – 34 years old. Immigration is bringing millions of additional renters into the market as well.

Additionally, generation Z has a population size of 67.06 million and those born within years 1997 – 2001 already reached prime renter age in 2023

Acquisition of Properties:

The Company will invest directly in multifamily investment properties located in the United States. Specifically, the Manager will search for multifamily real estate in stable and growth markets in Midwest (East North Central), South (East South Central) United States and nearby states. Stable and growth market characteristics include job and household formation growth, resulting in rising occupancy levels and rising rents. Numerous other factors contribute to the market determination process including but not limited to population growth, valuation trends, occupancy trends, demographic composition, economic conditions, and supply trends.

The Company intends to employ a rigorous underwriting process including proper due diligence, market valuation studies, and total return analyses. The Company plans to primarily invest in properties with strong cash flow, which are stable with opportunities to immediately improve property value post acquisition. The Company may also invest in properties that need some repositioning or capital investments, known as value-add, and thus, may not produce positive cash flow immediately. In either case, the Company intends to also work to improve the net operating income of each investment by improving revenue and operating margins, thereby raising property value.

The Manager will acquire properties with cash flow at the time of acquisition. Upon acquisition, the Manager intends to provide strategic physical and operational improvements to maximize investment return, but these enhancements should function as yield improvements and are not necessary to the safe performance of the investment. In this way, the Company effectively reduces risk and improves performance by assuring that each individual investment has multiple forces working to augment cash flow and property value.

Identifying Properties for Purchase:

The Manager will use its extensive network and highly specialized criteria for identifying, quantifying and qualifying investment opportunities.

The Manager intends to saturate its extensive relationships and network in each identified market to identify the very best opportunities. The Manager has established and maintained a comprehensive network of developers, banks, brokers, and other financial institutions which allow a strong market presence in target markets and robust market intelligence, strengthening our ability to identify properties within the Company’s criteria, often before entering into a market. This local knowledge and network of professional with deep knowledge of our target asset classes, we feel, gives the Company a competitive and strategic advantage.

The Manager’s goal is to identify the right property in the right market and potentially acquire it before it even hits the general market.

Post-Purchase Strategies:

The Manager intends that the properties will be held for the duration of the Company until the property is refinanced or sold. The Company intends to operate for ten (10) years.

The Company intends to hold properties with the intention of increasing values prior to sale of the property. The Company intends to use third-party management to cure inefficiencies in the management, cure deferred maintenance, and deploy strategic capital upgrades aimed increasing income and enhancing investor returns. The increase in cash flow should result in an increase in value so that the Company may sell or refinance the property for a profit at its proposed exit time of ten (10) years, or less than (10) years if possible.

The Company does not intend to take on projects that require extensive construction or rehab, but rather properties that will cash flow immediately. The Company will look to maximizing cash flow until sale, refinance or other disposition. The Company will also analyze market conditions and support the investment with multiple exit strategies to optimally exit each investment.

Financing Strategy

Once the proceeds of the Member’s capital contributions have been fully invested, the Company expects our debt financing will be in the range of approximately 70% to 80% of the aggregate value of real estate investments and other assets. Financing for acquisitions and investments may be obtained at the time an asset is acquired or an investment is made or at such later time as the management determines to be appropriate.

In addition, debt financing may be used from time to time for property improvements, lease inducements, tenant improvements and other working capital needs, including the payment of distributions. Additionally, the amount of debt placed on an individual property or related to a particular investment, including our pro rata share of the amount of debt incurred by an individual entity in which the Company invests, may be less than 70% or more than 80% of the value of such property/investment or the value of the assets owned by such entity, depending on market conditions and other factors.

The Company intends to limit borrowing to no more than 80% of the value of Company assets.

Exit Strategies

The Manager intends to operate the Company for up to ten (10) years. The Manager may employ multiple exit strategies including, but not limited to:

i. Sale of Properties: If the market allows for a successful sale of the properties to third parties or to Affiliate of the Manager so that the Members may realize appreciation, the Company will look to sell all of the properties owned by the Company to such third- party or Affiliates of the Manager.

ii. Refinance the Properties and hold: The Manager expects the Properties owned by the Partnership will have leverage not to exceed a 80% loan-to-value (“LTV”) ratio. If the then appraised values of the Properties show all Members may receive: a) their return of capital, and b) realized appreciation on the properties, the Company may elect to refinance the properties and return capital and any remaining appreciation.

iii. Sale to a Public Real Estate Investment Trust: The Manager may find that the properties are attractive purchases for certain public Real Estate Investment Trusts. The Manager may elect to a) sell the properties outright to the individual trust; b) sell the properties to the real estate investment trust in exchange for equity in the trust (stock) and cash (depending on the appreciation value); or c) create its own real estate investment trust to which the properties may be sold or exchanged. Note: if the Members were to receive stock of the purchaser real estate investment trust in exchange for their Interests, the Members may be able to sell their shares on the public exchange of which the public real estate investment trust is traded, so long as it is traded.

iv. Bulk Sale to an Institution: The Company may find an institution is interested in purchasing all the Company’s properties. The Manager may elect to take such an option, even at a discount, to ensure that all properties are sold in a timely fashion and so long as it is in the best interest of the Company.

The Company will make a decision regarding the appropriate exit strategy at the time in accordance with market conditions.